If your financial institution finds that your claim is not valid, it will send you a notice explaining why. All funds must be recredited within 45 calendar days after receiving your claim. Exceptions are made for new accounts, accounts repeatedly overdrawn, and suspicion of fraudulent activity. Your financial institution generally has 10 business days after receiving your claim to complete an investigation and recredit your account for up to $2,500 per check (plus interest if your account earns interest), pending completion of the investigation. If your loss is more than the amount of the substitute check, you may have the right under other laws to recover additional amounts of money.

#CHECKBOOK ORDER CHASE PLUS#

The amount of your refund under the special process is limited to the amount of your loss or the amount of the substitute check that you received, whichever is less, plus interest on that amount if your account earns interest. You may use the special process to get a refund of the money you lost. For example, you may think you were charged twice for the same check. What if a substitute check causes an error in my account?Ĭheck 21 provides a special process that allows you to claim a refund (also known as an expedited recredit) when you receive a substitute check from a financial institution and you think there is an error. Check 21 ensures you have the same legal protections when you receive a substitute check from your financial institution as you do when you receive an original check. Others may store original checks for some period of time and then destroy them. Many financial institutions destroy original paper checks. In general, the law does not require your financial institution to return your original check.

(Check 21), allows a financial institution to create and send a substitute check that is made from an electronic image of the original check. (You will be leaving and accessing a non-NCUA website. To address this need, a federal law, known as the Check Clearing for the 21st Century Act (opens new window)

In certain circumstances, however, financial institutions may need to use a paper check. Some financial institutions find that exchanging electronic images of checks with other financial institutions is faster and more efficient than physically transporting paper checks. You can use image statements and other copies of checks to verify that your financial institution has paid a check. Online check images and photocopies of original checks are not substitute checks either. For example, pictures of multiple checks printed on a page (also known as an image statement) that is returned to you with your monthly statement are not substitute checks.

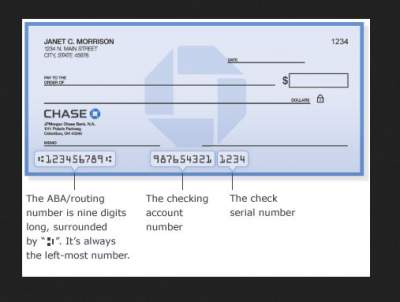

Not all copies of a check are substitute checks. The following sample shows what a substitute check looks like. You can use it the same way you would use the original check." The front of a substitute check should state: "This is a legal copy of your check. Substitute checks are specially formatted so they can be processed as if they were original checks. It may be slightly larger than the original check. A substitute check is a special paper copy of the front and back of an original check.

0 kommentar(er)

0 kommentar(er)